First Lecture: Introduction to Blockchain Technology

Introduction

Blockchain technology has transformed the landscape of financial markets by introducing decentralized systems that challenge traditional financial intermediaries. This lecture provides a foundational understanding of blockchains, with a focus on Bitcoin and Ethereum, the two most prominent platforms in the space.

Table of Contents

-

Readings

-

Brief Introduction to the history of Money

- Introduction to Bitcoin

- The Double-Spending Problem: Central Authority and Decentralized Solutions

- History and Evolution

- Brief history of distributed systems and cryptography. What was before bitcoin?

- Introduction to blockchain technology: Bitcoin’s white paper by Satoshi Nakamoto.

- Key Components of Bitcoin:

- Blocks and Transactions.

- Hashing, Merkle trees, and cryptographic keys.

- Consensus algorithms: Proof of Work (PoW).

- Purpose: Money and/or “Digital Gold”?

- Introduction to Ethereum

- History and Evolution:

- Brief history of Ethereum and why it was built.

- Introduction to Ethereum: Ethereum’s white paper by Vitalik Buterin.

- Purpose: World computer and contracts platform.

- Key Components of Ethereum:

- Ethereum Data: Blocks, Transactions, and how to use it in research.

- Consensus algorithms: Proof of Stake (PoS).

- Smart contracts and their potential.

- History and Evolution:

- Concluding Remarks and Research Within This Area

- Conclude the differences between Bitcoin and Ethereum.

- So what is Distributed Ledger Technology (DLT)?

- Different aspects of blockchains: Money, smart contracts, and Web3.

- Public vs. private blockchains.

Readings

The readings for this lecture will mostly consist of whitepapers. It is important to go to the source material when trying to understand this new technology, its vision, history and purpose.

Readings:

The Ethereum whitepaper can also be found in more of a markdown format at the Ethereum.org Website.

Note that both Bitcoin and Ethereum are evolving projects and their whitepapers serve as historical documents portraying their vision and lays the groundwork for understanding the protocols. However, to fully understand today’s version of the protocols further study is necessary.

For example,

An academic treatment of the economics of Ethereum can be found at:

The supplementary readings include:

- b-money whitepaper

- Hashcash paper

- Ethereum yellowpaper

- “Smart Contracts and Decentralized Finance” by John, Kogan, and Saleh (2023)

The b-money whitepaper can also be found here, however the version at Wei Dai’s website seems to be down.

The Ethereum Yellow Paper is the technical specification of the Ethereum blockchain, detailing its underlying mechanics, protocols, and algorithms. Written by Gavin Wood in 2014, it serves as the formal definition of the Ethereum Virtual Machine (EVM), providing the precise rules and instructions that govern how Ethereum operates, including how transactions are processed, blocks are validated, and smart contracts are executed. I very much recommend reading this paper for anyone that is interested in how Ethereum works.

Additionally, there are two books that I’ve found useful when learning the practical sides of the protocols:

As a last recommendation, for anyone interested in the history of Bitcoin and its development, I recommend looking into the “Cypherpunk mailing list”. This cryptography-focused mailing list from the 1990s was instrumental for the discussions and ideas that eventually influenced the creation of Bitcoin. The archived emails can be found and read online.

Brief Introduction to the History of Money

Before talking about blockchain technology, cryptocurrencies, and the cutting edge of modern financial technology, I think it can be useful to spend a few minutes thinking about what money is and what has been used as money throughout our history.

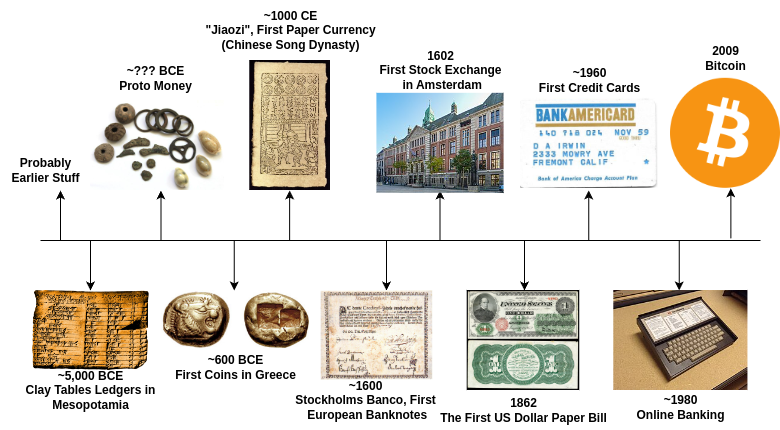

A timeline of some financial history:

The financial timeline above, is simply a few important financial technologies throughout human history. I left out many important events, such as the innovation of double-entry bookkeeping around 1200-1300 CE, and important milestones in banking. Nevertheless, the picture is supposed to make the reader reflect on our financial history.

Most of the events I included in the picture are related to money, but I also threw in the first stock exchange for good measures. Arguably, a reflection is that not much happened in relative terms until the 17th century. Another reflection, is that there has been an exponential change in (financial) technology starting in 1980s.

Below I give some additional details and context.

Pre Coinage

Human history is rich and we have found artifacts of our ancestors that are thousands of years old. Flutes, made from bird bone and mommoth ivory, were found at the Geissenkloesterle Cave in Germany’s Swabian Jura, and researchers used carbon dating to estimate that the flutes are between 42,000 and 43,000 years old (Higham et al., 2012). Stone tools that are over 1 million years old have also been found spread across Africa, Asia, and Europe, with the oldest found in at archaeological site Kokiselei 4 in Kenya and are dated to about 1.76 million years ago (Lepre et al, 2011).

However, surprisingly the oldest coins that have been found dates to around 600 BC and have their origin in Lydia in Ancient Greek. This begs the question: what currency was used before the introduction of coinage and how does our financial history look?

Barter is most likely the first form of trading that took place before any financial technology was invented. For example, tribes met and exchanged goods. The problem with coincidence of wants is however, that in order for trade to happen each party need to have demand for something that the other party possesses. In smaller communities with trust, barter work better since credit can be built on trust and reputation. When communities grow, trust in no longer default and barter becomes increasingly inefficient.

A ledger is a documentation of transaction to keep track of who owns what. The oldest known written ledger is clay tablets to keep track of commodities from Mesopotamia that are over 5,000 years old (Alden, 2023). In fact, these tablets were written in Sumerian, which is the oldest known type of writing. These tablets showed pictures of different commodities with quantities represented by dots.

Surprisingly, the known ledgers found are only 5,000 years old, which does not seem very impressive since we have artifacts that are thousands and even millions years old. Nevertheless, before the written ledgers there were likely oral ledgers or other less formal ways to keep track of ownership and debt. In smaller tribes before cities and villages, we can imagine that it was not as necessary to keep exact records since it was obvious anyways. When people started building larger societies trust became an issue and ledgers became necessary.

Alden (2023) highlights that across different periods in history, a wide array of items including stones, beads, feathers, shells, salt, furs, fabrics, sugar, coconuts, livestock, coffee, silver, and gold have functioned as money. Each of these items exhibits varying degrees of effectiveness based on the key attributes of money. An interesting essay about the origins of money is Nick Szabo’s essay “Shelling Out”.

Of all commodities, gold has the best characteristics when it comes to being money. Its only flaw as commodity money, is perhaps that it is not divisible enough. Even a very small amount of gold is still too valuable for small transactions. Even though silver has the same divisibility as gold, it is less scarce, meaning that silver is less valuable and therefore it has been historically used for smaller transactions.

Dawn of Coinage until Modern Times

Most scholars agree that the first coins (known to us) were minted around 600 BCE in ancient Greece in the Kingdom of Lydia (present day Turkey). Around the same year coins has also been found in China. In this context, a coin is defined as a piece of precious metal with man made shapes issued by some authority.

The Lydian coins were soon imitated, and coinage spread across the Greek world. At the time there was no clear standardization of coinage, leading to a vast landscape of interesting coins being minted. Interestingly, the money technology did not change much during the next millennium.

Modern money

The gold standard was a monetary system where currencies were directly tied to a specific amount of gold, ensuring stable exchange rates between countries. It ended during the Great Depression, leading to the Bretton Woods system in 1944, where the U.S. dollar was pegged to gold, and other currencies were pegged to the dollar. This system collapsed in 1971 when the U.S. suspended dollar convertibility to gold, marking the shift to a floating exchange rate system, which is what we have today. In the current system, major currencies are freely traded and determined by market forces rather than being backed by a physical commodity.

Modern money primarily consists of fiat currency, which has no intrinsic value and is not backed by a physical commodity like gold. Instead, its value is derived from government regulation and trust in its stability. Fiat money can exist as physical cash (coins and banknotes) or as digital money, which makes up the majority of modern transactions. Digital money includes bank deposits and balances in electronic payment systems, which are typically created through credit by commercial banks when they issue loans. Central banks, like the Federal Reserve, control the issuance of base money (cash and central bank reserves) and influence the money supply through monetary policy tools such as interest rates and open market operations.

Introduction to Bitcoin

Note: Bitcoin (with uppercase B) refers to the Bitcoin network and bitcoin (with lowercase b) refers to the cryptocurrency.

The Double-Spending Problem: Central Authority and Decentralized Solutions

The Double-Spending Problem is a fundamental challenge in any digital currency system. It refers to the risk that a digital asset, such as currency, can be copied and spent multiple times. In contrast to physical money, where you physically hand over cash, digital money can theoretically be duplicated or “counterfeited” in a digital environment, creating the risk of fraudulent transactions.

Centralized Solution to the Double-Spending Problem

In traditional financial systems, the double-spending problem is solved by relying on a central authority, typically a bank or payment processor, to verify all transactions. Here’s how it works:

-

Central Ledger: In centralized systems, the bank or authority maintains a central ledger where every transaction is recorded. When you make a transaction (e.g., sending money through your bank), the central authority checks its ledger to ensure you have the funds and then debits your account while crediting the recipient’s account.

-

Trust in the Central Authority: The users of the system must trust the central authority to accurately maintain this ledger and prevent fraud. The bank, as a trusted intermediary, ensures that money cannot be spent twice by the same party and that transactions are valid. In effect, the bank acts as the final arbiter of all transactions.

Efficiency but Vulnerability: While this system works well and efficiently, it comes with downsides:

- It creates a single point of failure, meaning that if the central authority is compromised (through hacking, corruption, or errors), the entire system could fail.

- It requires trust in a central party, which may be costly or difficult to establish in certain environments.

- It is not decentralized, meaning participants must submit to the rules and oversight of the central authority.

Arguably there is no real issue in developed countries with institutional trust. However, one can think of how innovation is affected by centralized versus decentralized systems.

Decentralized Solutions and Bitcoin’s Breakthrough

In a decentralized system, however, solving the double-spending problem is much more complex because there is no single entity to trust for transaction verification. Bitcoin’s key innovation was solving the double-spending problem without needing a trusted intermediary, using a combination of cryptographic techniques and decentralized consensus mechanisms.

The Challenge in Decentralized Networks:

In a decentralized network, anyone can join and participate, and no single party is in charge of maintaining the ledger or validating transactions. The challenge is ensuring that all participants (nodes) in the network agree on the state of the ledger (the blockchain) without any party being able to cheat by spending the same funds twice. This requires the network to reach a consensus on which transactions are valid, without trusting any individual participant.

Proof of Work (PoW) as a Solution:

Bitcoin solves this problem using Proof of Work (PoW) and a distributed ledger (the blockchain). Instead of relying on a central authority, miners (participants in the network) compete to solve a cryptographic puzzle to validate new blocks of transactions. Once a block is solved, it is broadcast to the entire network and added to the blockchain. Because the PoW process is computationally difficult and resource-intensive, altering the blockchain (and double-spending) would require enormous amounts of computing power, making it impractical for an attacker to alter transaction history.

Decentralized Consensus:

Each node in the Bitcoin network keeps a copy of the blockchain, and through the PoW mechanism, all nodes agree on which version of the blockchain is correct. When a valid block is added, it is automatically accepted by the majority of the network as part of the ledger. This decentralized consensus prevents double-spending because all transactions must be validated by the entire network, making fraudulent transactions extremely difficult.

Irreversibility and Finality:

Once a transaction is confirmed and added to a block in the blockchain, it eventually becomes part of the immutable ledger. Changing that transaction would require not only reversing the block where the transaction is included but also redoing all the computational work of the subsequent blocks, an infeasible task as more blocks are added. This ensures that once a transaction is confirmed by the network, it is soon considered final and irreversible, solving the double-spending issue without a central party.

Brief History and Evolution of Bitcoin

The core ideas that led to the creation of Bitcoin were developed from earlier concepts in cryptography and distributed systems. Before Bitcoin, there were attempts to create digital currencies, but none solved the double-spending problem in a decentralized manner.

-

b-money (Wei Dai, 1998): In 1998, Wei Dai proposed b-money, a concept for an anonymous, distributed digital cash system. This proposal introduced key elements like a decentralized network, anonymous transactions, and the idea of using a ledger to track balances. Though never implemented, b-money influenced later developments, particularly Bitcoin.

-

Hashcash (Adam Back, 2002): Proposed by Adam Back in 2002, Hashcash was designed as a proof-of-work system to limit email spam and prevent denial-of-service attacks. The concept of proof-of-work (PoW) was later adopted by Bitcoin to secure the network and control the issuance of new bitcoins.

-

E-gold (1996) and DigiCash (David Chaum, 1990s): Both e-gold and DigiCash were attempts at creating digital currency systems, but they relied on centralized entities, which made them vulnerable to regulatory pressure and attacks. These systems were ultimately shut down, highlighting the need for a decentralized solution like Bitcoin.

Bitcoin emerged as the first truly decentralized digital currency, building on these previous attempts. It solved the double-spending problem without the need for a trusted third party by using a blockchain and proof-of-work.

In 2008, Satoshi Nakamoto released the Bitcoin white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This seminal document laid out the fundamental architecture of Bitcoin, focusing on how a decentralized, peer-to-peer network could function without intermediaries.

The white paper describes Bitcoin’s use of a blockchain, where blocks of transactions are linked together through cryptography, forming an immutable chain. The blockchain prevents double-spending by ensuring that each bitcoin transaction is unique and verified by network participants through proof-of-work consensus.

The goal was to create a decentralized currency system, free from the control of governments and central banks, and a form of “digital cash” that anyone could use globally.

As an additional note:

The Cypherpunk email list, active during the 1990s and early 2000s, was a crucial forum for discussions around privacy, cryptography, and the creation of decentralized systems. It was on this list that many foundational ideas for digital currencies, such as Bitcoin, were debated and refined. The mailing list included prominent figures such as Hal Finney, Wei Dai, Adam Back, and Nick Szabo, who all contributed to discussions on cryptographic protocols, privacy technologies, and electronic cash. Topics such as anonymity, decentralization, and resistance to censorship were central themes, many of which would later be embodied in Bitcoin’s design. For the interested reader, the archived emails offer a glimpse into the early development of cryptographic innovations and the ideological foundations that led to Bitcoin’s creation. Reading through the archives can provide insight into the motivations, technical challenges, and debates that shaped the early digital currency movement. These archives are available online and provide a rich history of the development of many technologies that underpin Bitcoin today.

Key Components of Bitcoin

The Bitcoin protocol consists of a few key components outlined in Bitcoin’s white paper by Satoshi Nakamoto. Let’s go through them.

The Bitcoin Network

To understand Bitcoin, it’s helpful to think of it as a set of rules, or a protocol, that, when followed by a network of computers (called nodes), forms the Bitcoin network. These rules govern how value is transferred, how the network is secured, and how consensus is reached on the state of the blockchain. Importantly, there is no central server running Bitcoin. It is a decentralized system, meaning the network is maintained by the nodes themselves, without a central authority controlling it.

Blockchain

A blockchain is a digital ledger, or database, designed to record information securely, transparently, and in a tamper-resistant manner. It consists of a series of blocks, each containing a set of data, such as transactions. These blocks are cryptographically linked to the previous ones, creating a continuous, unalterable chain. This structure ensures that once data is added, altering it would require changing all subsequent blocks, making manipulation extremely difficult. This makes blockchain an effective way to store data in decentralized systems like Bitcoin. Note that the blockchain is called “Timestamp Server” in the Bitcoin Whitepaper.

While “blockchain” has become a popular buzzword, often used interchangeably with terms like “cryptocurrency,” at its core, it is simply a data structure for storing information in linked blocks. Bitcoin leverages a blockchain to store its transaction history, but it relies on several additional technologies to ensure the Bitcoin protocol functions as intended.

Digital Signatures

Bitcoin transactions use a public-private key cryptographic system based on the Elliptic Curve Digital Signature Algorithm (ECDSA). This system ensures that only the legitimate owner of a Bitcoin address can authorize the spending of funds associated with that address, providing both security and proof of ownership.

Each Bitcoin address is derived from a public key, which is in turn generated from a corresponding private key. The private key is a randomly generated 256-bit number that is known only to the owner. The public key is mathematically linked to the private key, but due to the properties of elliptic curve cryptography, it is computationally infeasible to derive the private key from the public key.

However, while digital signatures ensure ownership and prevent unauthorized spending, they do not prevent double spending on their own. Double spending occurs when a user attempts to spend the same bitcoins in multiple transactions. Bitcoin’s proof of work consensus mechanism, through block confirmations, addresses double spending by ensuring that only the first valid transaction is added to the blockchain.

Bitcoin Addresses (“Accounts”)

Unlike traditional financial systems where an account is defined by a balance tied to an individual or entity, Bitcoin does not have “accounts” in the conventional sense. Instead, Bitcoin transactions revolve around addresses and the Unspent Transaction Output (UTXO) model.

A Bitcoin address is derived from the public key associated with a user’s private key. It serves as the location where funds are sent and received. Unlike traditional accounts, a Bitcoin address does not have a fixed balance stored in a ledger. Instead, the network tracks UTXOs associated with that address, which are sums of bitcoin that have been received but not yet spent.

Ownership of bitcoins is demonstrated via a pair of cryptographic keys (public and private). A user controls the private key that corresponds to the public key associated with a given address. Only the holder of the private key can authorize a transaction to spend the bitcoins associated with that address.

Bitcoin Transaction

A transaction in Bitcoin represents the movement of bitcoins from one address to another. Each transaction is signed using the sender’s private key to ensure authenticity.

When a user wants to transfer Bitcoin, the transaction must be signed using the private key associated with the sender’s address. This ensures that the transaction is legitimate and has not been tampered with. Here’s a more detailed breakdown of the process:

-

Hashing the Transaction Data: Before signing, the transaction data (including inputs, outputs, and amounts) is hashed using the SHA-256 cryptographic hash function. This creates a fixed-length digital fingerprint of the transaction, called the message hash, which is used as the input to the signature algorithm.

-

Creating the Digital Signature:

-

The user’s private key is then used to sign the message hash. This produces a unique digital signature for the transaction. The ECDSA algorithm generates two components for the signature: r and s. These values depend on both the private key and the message hash, ensuring that the signature is unique for each transaction, even if the same private key is used.

-

Broadcasting the Transaction: Once the transaction is signed, it is broadcast to the Bitcoin network along with the public key and the signature (r, s values). This allows miners and full nodes to verify the authenticity of the transaction.

-

Bitcoin Block

A block in Bitcoin contains a collection of verified transactions, along with additional important data that secures and structures the blockchain. Each block includes a block header, which contains metadata such as the timestamp (indicating when the block was created), the difficulty target (reflecting how hard it was to mine the block), and most importantly, the hash of the previous block. By referencing the previous block’s hash, each block is cryptographically linked to the one before it, forming a continuous and immutable chain known as the blockchain.

The block also includes the Merkle root, which is a cryptographic summary of all the transactions within the block. This structure allows for efficient and secure verification of each transaction without needing to store all of them individually.

Additionally, each block contains a special transaction called the coinbase transaction, which rewards the miner with newly minted bitcoins and transaction fees. Once a block is added to the blockchain, it becomes a permanent part of Bitcoin’s ledger, ensuring the integrity of the network and preventing double spending.

Blocks are added to the blockchain approximately every 10 minutes, with the system automatically adjusting the difficulty of mining to maintain this interval.

Bitcoin Consensus: Proof of Work (PoW)

Bitcoin achieves decentralized consensus through a mechanism called Proof of Work (PoW). In this system, specialized computers known as miners compete to solve a cryptographic puzzle that requires significant computational effort. This puzzle involves finding a number, called a nonce, that when combined with the block’s data and hashed using the SHA-256 algorithm, produces a hash value that is lower than a specified target, known as the difficulty target.

The mining process serves two main purposes:

-

Securing the Network: By requiring miners to perform substantial computational work, PoW ensures that adding a block to the blockchain is costly and difficult. This prevents malicious actors from easily altering past blocks or creating fraudulent ones, as they would need to re-mine all subsequent blocks, which would require enormous computing power.

-

Achieving Consensus: Once a miner successfully finds a valid nonce, the block is broadcast to the network, and other nodes verify its validity. If the block is valid, it is added to the blockchain, and the miner is rewarded with newly created bitcoins (known as the block reward) and transaction fees. This process ensures that all participants in the network agree on the current state of the blockchain without the need for a central authority.

The difficulty of the PoW puzzle is adjusted approximately every two weeks (or every 2,016 blocks) to ensure that blocks are added roughly every 10 minutes, regardless of the total computational power of the network.

PoW makes Bitcoin’s consensus process trustless, as participants do not need to trust each other or a central party. Instead, they rely on the economic incentive structure and the computational difficulty of solving the PoW puzzle to maintain the integrity and security of the blockchain.

Miner Incentives

Bitcoin miners are incentivized to secure the network and validate transactions through a system of block rewards and transaction fees. Each time a miner successfully adds a new block to the blockchain, they receive a block reward consisting of newly minted bitcoins, along with any fees from the transactions included in the block. The block reward undergoes a process called halving every 210,000 blocks (approximately every four years), reducing the number of new bitcoins miners receive by half. Initially set at 50 BTC per block, this reward is now 6.25 BTC as of the last halving in 2020. The halving process continues until the total supply of Bitcoin reaches the fixed limit of 21 million bitcoins, expected around the year 2140. Once the cap is reached, miners will no longer receive new bitcoins as a reward and will instead rely solely on transaction fees to sustain their operations. This gradual transition incentivizes miners to continue securing the network while keeping the Bitcoin supply scarce and deflationary.

The Complete Process of Bitcoin

The following explainatoin comes from the Bitcoin Whitepaper, and nodes here are thought of as “miners”.

The steps to run the network are as follows:

- New transactions are broadcast to all nodes.

- Each node collects new transactions into a block.

- Each node works on finding a difficult proof-of-work for its block.

- When a node finds a proof-of-work, it broadcasts the block to all nodes.

- Nodes accept the block only if all transactions in it are valid and not already spent.

- Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

Nodes always consider the longest chain to be the correct one and will keep working on extending it. If two nodes broadcast different versions of the next block simultaneously, some nodes may receive one or the other first. In that case, they work on the first one they received, but save the other branch in case it becomes longer. The tie will be broken when the next proofof-work is found and one branch becomes longer; the nodes that were working on the other branch will then switch to the longer one.

New transaction broadcasts do not necessarily need to reach all nodes. As long as they reach many nodes, they will get into a block before long. Block broadcasts are also tolerant of dropped messages. If a node does not receive a block, it will request it when it receives the next block and realizes it missed one.

Purpose of Bitcoin: Money and/or “Digital Gold”?

Bitcoin was initially proposed as a peer-to-peer electronic cash system for facilitating everyday transactions. Over time, it has evolved into what many see as “digital gold” – a store of value rather than just a medium of exchange. This transition is partly due to Bitcoin’s fixed supply (capped at 21 million coins) and its decentralized, censorship-resistant nature.

-

As Money: Bitcoin can function as a currency for buying goods and services. However, its high volatility has made it less practical for everyday use in comparison to stable fiat currencies.

-

As “Digital Gold”: Many investors now view Bitcoin as a store of value or an asset that can hedge against inflation and economic instability, similar to how gold has been used historically.

One of the ongoing debates surrounding Bitcoin is whether it needs to have intrinsic value to be valuable. Traditional forms of money, like gold, are considered to have intrinsic value because of their physical properties. Bitcoin, on the other hand, derives its value from network effects, scarcity, security, and trust in the decentralized system.

The reader should think about:

- What properties does bitcoin have that is an advantage compared to other currencies?

- Is bitcoin an asset or a currency?

- Does bitcoin have intrinsic value and does it matter?

- How can we price bitcoin? Why is it worth X dollars today?

Introduction to Ethereum

Ethereum is the second-largest blockchain system after Bitcoin. While it shares similarities with Bitcoin, such as using a decentralized ledger, Ethereum offers far more flexibility. In addition to simple transactions like “send X bitcoins to wallet Y,” Ethereum allows blockchain transactions to include complex computer code. This enables the creation of decentralized applications, including entire trading exchanges, which can operate directly on the Ethereum blockchain. We’ll explore decentralized finance (DeFi) in more detail in the second lecture.

History and Evolution of Ethereum

While Bitcoin laid the foundation for decentralized digital currencies, Ethereum expanded the concept to create a decentralized platform for programmable applications, known as smart contracts. The vision for Ethereum was outlined in a 2013 whitepaper by Vitalik Buterin, a developer and early Bitcoin enthusiast. Buterin proposed Ethereum as a blockchain that could support more than just a cryptocurrency, allowing developers to build and deploy decentralized applications (dApps) on a shared, decentralized infrastructure.

Buterin’s idea came from recognizing Bitcoin’s limitations. While Bitcoin’s blockchain is designed to facilitate peer-to-peer transactions and securely store value, it lacks the flexibility to support more complex applications. Ethereum was designed to address this limitation by introducing a Turing-complete programming language, allowing developers to create arbitrary rules and logic on top of the blockchain.

The Ethereum project officially began in 2014 when Buterin, along with co-founders Gavin Wood, Joseph Lubin, and others, launched a public crowdsale (Initial Coin Offering, or ICO) to fund development. The ICO was one of the earliest examples of raising funds through the sale of tokens, raising over $18 million. This led to the launch of the Ethereum mainnet in July 2015, with the network supporting both the native cryptocurrency Ether (ETH) and a platform for decentralized applications.

Ethereum introduced the implementation of smart contracts, self-executing contracts where the terms are directly written into code. This innovation revolutionized the blockchain space by enabling use cases far beyond just payments, Ethereum could now support decentralized finance (DeFi), gaming, digital identity, and even governance systems. Its versatility quickly made it the most popular platform for decentralized application development.

Since its launch, Ethereum has undergone several major upgrades, with the most significant being the transition from Proof of Work (PoW) to Proof of Stake (PoS), which is part of what was formerly referred to as “Ethereum 2.0.” Now called the consensus layer, this upgrade began with the launch of the “Beacon Chain” in December 2020 and culminated in “The Merge” in September 2022, where Ethereum fully transitioned to PoS. This shift aims to make the network more energy-efficient, scalable, and secure. Ethereum continues to evolve, driven by an active developer community and a wide range of use cases that go beyond simple financial transactions.

As you can understand, the blockchain space and its development is highly complex and evolves rapidly. The pace of innovation and the technical depth of concepts like consensus mechanisms, smart contracts, and decentralized applications make it challenging to grasp everything instantly. Even for those familiar with traditional finance or technology, it takes months of studying and hands-on experience to fully understand how these systems work, how they interact, and their potential impact. Ethereum, with its dynamic ecosystem and continuous upgrades, exemplifies this complexity, requiring a deep dive into both the technology and the economics that drive it.

Key Components of Ethereum

Ethereum Addresses (“Accounts”)

In contrast to Bitcoin’s UTXO model, Ethereum uses an account-based model, similar to traditional banking systems. Instead of tracking unspent outputs, Ethereum maintains a global state where each account has a balance that is updated directly with each transaction. There are two types of accounts in Ethereum: externally owned accounts (EOAs), which are controlled by private keys, and smart contract accounts, which are controlled by code. When a transaction is sent from an EOA, the sender’s balance is reduced, and the recipient’s balance is increased without creating or consuming discrete UTXOs. This model simplifies operations such as sending funds and executing smart contracts, but it requires more complex state management since all account balances and contract states must be updated and maintained globally by all nodes.

Concluding Remarks

Questions

The following this lecture, these questions are useful for the reader to think about and try to understand. They are also an aid for the students in studying for the exam:

- What is money? Can cryptocurrency be money? Does money need to have “intrinsic value” (what is even that)?

- What are the core differences between Bitcoin and Ethereum? Think about both the technology and the use cases.

What statements are true and false about Bitcoin:

- A transaction can be reversed.

- Bitcoin solves the double spending problem.

- Bitcoin transactions relies on a trusted third party.

- The Bitcoin network is secure as long as the honest nodes controls the majority of the hash power.

- If a malicious actor controls 51% of Bitcoin’s hash power, it can send bitcoins from other actors accounts in a “51% attack”.

References

-

Higham et al., 2012, Τesting models for the beginnings of the Aurignacian and the advent of figurative art and music: The radiocarbon chronology of Geißenklösterle, Journal of Human Evolution.

-

Lepre et al., 2011, An earlier origin for the Acheulian, Nature.

-

Lyn, Alden, 2023, Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better, Timestamp Press.